07_Creative Financing Solutions for Smooth Business Transitions

07_Creative Financing Solutions for Smooth Business Transitions

![]() | Disclosure and Transparency Statement: This article includes AI-generated content; see the complete statement below.

| Disclosure and Transparency Statement: This article includes AI-generated content; see the complete statement below.

Seller Financing and Earnouts: Navigating Critical Tools for Business Transitions

Today's business landscape is continuously evolving with incredible speed and complexity. High valuations, fast-moving market trends, and ever-changing financial conditions make buying and selling a business more intriguing yet challenging than ever before. Seller financing and earnouts are two critical and innovative financial strategies that help bridge the key gaps between buyers and sellers, facilitating smooth business transitions.

What is Seller Financing?

Let's break this down. Seller financing allows a business's seller to finance the sale by letting the buyer pay in installments over an agreed timeframe. The financing terms, like repayment schedules, interest rates, down payments, etc., are customized and negotiated rather than set in stone. This allows both parties room to navigate the complexity of the deal.

Seller financing provides enormous benefits, especially when traditional business loans are difficult to obtain. For example, consider a small tech startup, TechInno, with an unconventional business model. They wish to buy an AI company that perfectly complements their offerings but struggle to convince traditional financiers. Here, seller financing allows the startup to agree on workable repayment terms with the sellers, letting them take over the business without high upfront capital needs. The AI company owners also benefit by structuring an attractive return through interest earnings over time rather than settling for a low valuation today. A win-win for both parties!

What are Earnouts?

Earnouts allow sellers to tie a portion of the deal price to the future financial performance of the business after its sale. Simply put, sellers receive additional compensation if the company achieves certain earnings or revenue targets during a pre-agreed timeframe. So, both buyers and sellers share the upside if the business thrives under new management.

Consider Organics Co, a specialty grocery store chain, confident of rapid growth despite current slow sales. The eager sellers negotiate an earnout clause with buyers that guarantees an additional $2M payment if annual revenues grow 30%+ within three years after acquisition. This earnout motivates the buyers to boost performance post-sale rather than make short-term cuts, creating a shared stake in Organics Co's success. The sellers also get to participate in the business' upside. A masterstroke of alignment!

Building Creative Bridges

Seller financing and earnouts reflect the creativity and adaptability required to excel in today's complex business deals landscape. These strategies bridge the critical gaps between buyers and sellers regarding business valuation, financing constraints, and risk management. As we explore the intricacies of ownership transitions, the criticality of understanding and applying these instruments becomes very clear. They allow entrepreneurs and investors to build strategic bridges that turn complex transactions into shared visions of growth and continuity.

Benefits of Seller Financing for the Seller and Buyer - A Win-Win Tool for Business Transactions

Seller financing arrangements have become increasingly popular in recent years as businesses seek more creative pathways for ownership transitions. Why does this mechanism resonate so much with both buyers and sellers? As we analyze the multifaceted benefits, it becomes evident that seller financing goes beyond financial convenience to become a strategic win-win tool.

Why Sellers Love Seller Financing

For sellers, opting to finance a portion of the deal rather than demanding a sizeable lump-sum payment offers some clear advantages:

- Wider Buyer Pool: Offering financing terms expands the potential buyer pool, attracting those without ready access to capital but with solid operating abilities. It is instrumental in niche sectors. For example, an innovative sports tech startup will have limited external buyers. Seller financing allows buyers from within the industry looking to expand their footprint.

- Higher Valuations: Creative financing arrangements allow sellers to demand higher valuations for the business than outright sales. This premium valuation compensates for the added risk sellers take. Moreover, the shared stake also includes the business' future upside.

- Ongoing Revenue Stream: Seller financing payments over time can surpass income from investing a lump sum in a low-interest rate environment. The interest earnings provide consistent long-term revenue.

Tax Optimization: Structured correctly, seller financing allows capital gains taxes to be spread over several years, unlike lump-sum sales, which optimizes overall taxes.

Why Buyers Love Seller Financing

For buyers, seller financing delivers meaningful plusses:

- Access to Capital: New entrepreneurs or businesses with limited collateral find accessing external capital extremely tedious. Seller financing offers a much easier pathway to finance acquisitions, growth, and smooth ownership transitions.

- Flexible Structures: Unlike strict banker-imposed terms, seller financing allows custom structures aligned to the business needs - deferred down payments, balloon payouts, favorable interest costs, and more. Both parties can get creative.

- Quicker Deals: With seller financing in place, deals can close much faster as extensive due diligence and financing paperwork get minimized for buyers, speeding up acquisition pathways.

- Signal of Confidence: When sellers offer financing options, it signals their confidence in the business' health. This validity gives buyers additional comfort.

Illustrative Example: California-based boutique winery Napa Valley Cellars became a runaway success as its award-winning Cabernet Sauvignon attracted buyers globally. As the founders considered retirement, they negotiated a seller-financed deal with a consortium of wine fanatics. This deal gave the buyers more accessible financing terms, allowing the founders to reap higher valuations and share in the business' upside through interest earnings and earnouts. A fine wine getting even better with age!

Seller financing creates shared incentives that build trust and alignment between both parties while satisfying their personal goals. Indeed, it is a delicate balancing act that promises greater success in times ahead!

Crafting Win-Win Seller Financing Deals

Seller financing is an art that allows creative structuring but still requires careful planning and negotiation to ensure mutually beneficial deals. Buyers and sellers can effectively balance risks and align incentives by understanding the critical components and adopting the right strategies.

Key Elements of Solid Structures

- Down Payments: The size of upfront down payments is a crucial indicator of the buyers' confidence and commitment. Larger down payments give sellers greater security but may strain buyers' finances. The ideal sizes are worked by assessing budgets, risks, and financing options.

- Interest Rates: Higher interest rates compensate sellers for the risk they shoulder through financing. However, rates set too high can financially burden buyers. Market benchmarks, corporate bond yields, and policy rates are references for negotiating fair interest rates.

- Repayment Timelines: Customizing repayment schedules allows synchronization with the inherent cash flow cycles of the business – seasonal revenue spikes, inventory build-ups, and even one-time investments or capital expenditures. Smooth payout deadlines ensure continuity.

- Term Length: The financing term length impacts both buyers and sellers. Short 3-5 year terms limit sellers' risk exposure while more extended 7-10 year structures reduce large near-term repayments for buyers through small incremental payments.

- Collateralization: Sellers primarily secure the financing against assets or equity shares of the business itself, providing robust comfort. Additional collateralization is often necessary to balance risks - especially for larger deals.

Best Practices For Success

- Customization is Key: Deals must be tailored, not standardized. When designing optimal structures, factor in the business model, industry, and growth projections.

- Independent Expertise: Seeking guidance from experienced legal and finance partners enables the construction of fair, viable, and mutually beneficial agreements with balanced risks.

- Open Communications: Sellers preferring quicker exits may opt for shorter-term financing, while buyers eyeing rapid scale-up might desire longer repayment runways. Both outlooks must align.

Illustrative Example: A classic custom deal structure in action - the $2M sale of family-owned candy retailers Sweet Treats to first-time entrepreneurs. The anxious sellers mandated a 50% down payment from personal capital raised by the buyers, reasonably high 8% interest rates, and 3-year financing terms to limit their risk. In return, they reinforced collateral through a security interest in the stores' properties. This structure induced buyers' skin in the game while providing sellers satisfactory risk protection. Though demanding, the deal enabled dreams on both sides to become reality!

Every successful seller financing deal requires asking the right questions, making trade-offs, and striking the right chords. But when done right, these arrangements hit the sweet spot in aligning buyer-seller interests toward shared prosperity.

Understanding Earnouts and Their Structure for Rewarding Partnerships

Earnout provisions are increasingly being applied in business transactions where future potential outweighs current performance. By deferring portions of the consideration and linking payments to success milestones over time, earnouts allow buyers and sellers to bridge valuation gaps through rewarding partnerships that share future upside.

Earnout provisions enable smaller, ambitious companies to agree on strategic deals that promise shared rewards aligned with growth milestones. By deferring portions of the deal value and linking payments to future targets, earnouts help dynamic owners, and investors bridge valuation gaps through partnerships built to last.

The Earnouts Mechanism

Earnout structures essentially involve variable or contingent price components in transactions where base valuations today fail to capture future growth potential appropriately. Sellers receive pre-defined additional payments if the business achieves certain performance thresholds over an agreed post-acquisition timeframe, allowing them to gain higher values. For buyers, it prevents overpaying for unproven projections. The message is clear - pay more if I can grow more!

Earnouts allow variable or contingent payments in transactions where high future upside fails to reflect in current valuations acceptable to both parties. Sellers gain periodic upside from pre-agreed targets, while buyers avoid overpaying for projections. Simply put - pay more ONLY if we grow more!

Consider a medical devices startup, Medi Tech, who cannot agree on a deal price with potential investors. The founders demand a $3M valuation based on revolutionary patent potential, while investors offer only $2M, given no proven traction. Earnouts save the day! The two sides agree on a $2.5M upfront payment plus an additional $500K if Medi Tech achieves $1M in sales within three years post-investment, aligning risk and reward.

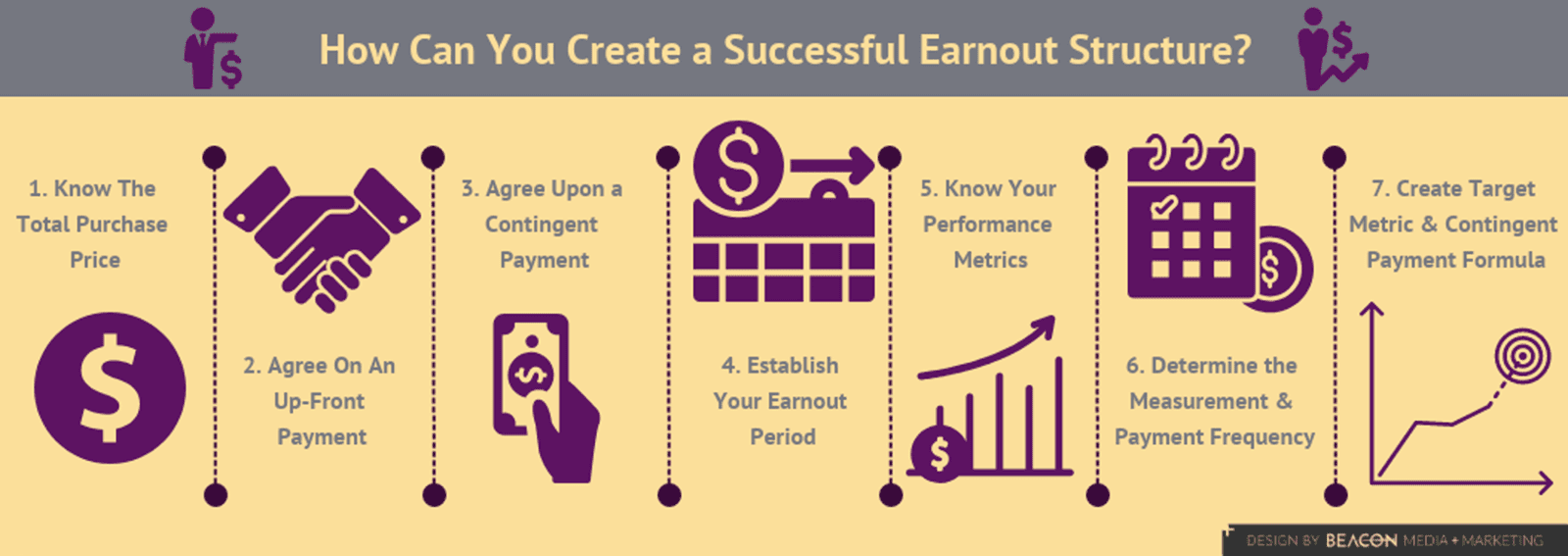

Structuring Effective Earnout Frameworks - Performance Milestones

Milestones must balance realism and ambition using achievable yet motivating targets and well-defined operational, financial, or time-based metrics tailored to business fundamentals. Consider stretching revenue growth goals across years while adding regulatory approval targets. We must balance realistic and motivating metrics - say, 30% sales growth over two years. Certifications also work.

For example, progressively stretching annual revenue growth goals over 2-3 years allows realistic room for buyer execution. Additionally, external certification achievements like ISO 9001 quality standards or specific industry-relevant badges also make good milestones demonstrating broader operational improvements and market credibility under new management rather than just pursuance of plain vanilla financial growth metrics, which could risk short-term number games or under-investment in assets such as R&D that promote long-term success. Thus, certificates validate that growth has been responsibly and sustainably achieved.

- Duration: Earnout timelines should allow reasonable runways to achieve milestones while retaining the relevance of the metrics. For Medi Tech, a 2-4-year window gives adequate scale-up room after factoring in lengthy FDA procedures.

- Payment Schedules: Structured payouts linked to specific milestone achievements provide periodic motivation and cash inflow visibility. However, single-bullet payments prevent frequent disputes.

- Measurement Methodology: Consistent accounting policies, independent audits, and unambiguous target definitions eliminate disputes and allow objective performance assessments.

Illustrative Example: When eco-friendly laundry service Pure Fresh sought a strategic investor for expansion capital, the founder insisted on a $4M valuation based on expected growth. However, investors offered only $3M, given the stability risks of the organic laundry market. Both parties eventually agreed to a $3.3M upfront investment plus a $700K earnout if Pure Fresh opened two new locations and maintained 50%+ gross margins over two years post-investment. This milestone-based upside sharing aligned risk and reward.

In closing, earnouts exemplify the future of M&A - shared risk, shared reward. As business valuations get influenced by increasingly dynamic drivers, earnouts offer the perfect tools to link consideration to performance and partnership.

Risks and Mitigation Strategies in Seller Financing and Earnouts

While seller financing and earnouts enable customized transaction structures, they expose stakeholders to material risks necessitating careful navigation. Businesses can balance deal flexibility with durability by acknowledging inherent risk factors and instituting prudent mitigating strategies.

Seller Financing Risks

- Buyer Default: Buyers defaulting on financing payments pose a considerable risk for sellers. Warning signs include overleveraged buyers, lack of financial discipline, business headwinds, and unethical conduct. Screening buyer credibility is thus critical upfront.

- Business Deterioration: Post-sale business performance stresses can restrict buyers from meeting committed payment obligations to sellers on time. Sectors with revenue volatility see higher risks for sellers.

- Enforcement Costs: In instances of disputes or defaults, substantial legal and administrative costs may be incurred by sellers seeking to enforce contracts or regain control of the business.

Earnouts Risks

- Target Disagreements: Vaguely defined or easily manipulable earnout targets risk good faith disputes post-close over achievement between parties. Even fast growth cannot be singularly indicative of health.

- Business Distortion: Perverse incentives promote short-term manipulation of metrics through cuts in discretionary spending, such as R&D investments or advertising, to meet earnout goals rather than drive long-term gains.

- Post-Close Integration: Poor integration alignment or leadership conflicts post-close may fail to harness the full business potential and earning capacity, leading to missed earnout targets. Cultural clashes often play spoilsport.

Prudent Risk Mitigation

Stringent Due Diligence: Assessing buyer credibility and long-term business viability beyond earnings projections is vital when structuring seller financing or high-value earnouts.

Watertight Contracts: Precise earnout performance metrics, seller financing default triggers, and clear breach penalties need proper contract articulation to prevent conflicts.

Incentive Alignment: Part incentive-based earnout structure payments should also be tied to longer-term metric goals to promote sustainable growth.

Oversight Governance: Establishing joint governance structures for objective business performance oversight and fair earnout assessment instills confidence in all parties involved.

Building Trust: Fostering trust-based relationships, transparent communications, and empathy across the table dilutes perceptions of misdoing and fosters resilience even in adversity.

Illustrative Example: A specialty cupcake retailer, Cuppy Cakes, looking to sell to new owners through a seller-financed deal, made its buyer undergo extensive due diligence assessing financing credibility and maintaining operations post-transition. The earnout incentives also promoted network expansion rather than only sales spikes. Further, independent performance benchmarking and oversight mechanisms were instituted along with open escalation policies aimed at sustaining collaboration and growth.

Therefore, dealmakers can reap the full benefits of creative agreements that promise to nurture value by acknowledging risks upfront, securing prudent safeguards, and emphasizing resilient partnerships.

Conclusion - Navigating Seller Financing and Earnouts by Charting Creative Deal Pathways

This journey through seller financing and earnouts' intricacies reveals their role as strategic conduits enabling continuity and growth in ownership transitions, especially for high-potential small businesses. By aligning risk and reward, these mechanisms turn complex transactions into shared visions of prosperity.

However, the risks around defaults, disputes, and misaligned priorities cannot be ignored and warrant careful mitigation through robust due diligence, watertight contracts, balanced incentive structures, and impartial oversight governance.For sellers, these structures optimize sales proceeds and offer ongoing participation in business upside through secured income streams while extracting higher valuations. Sellers expand the playing field through flexible options, benefiting new entrepreneurs with potential.

For buyers, they enable access to growth capital, management control without prohibitively high upfront payout needs, customized repayment options, and incentives promoting business expansion. Earnouts, in particular, allow focus on value creation levers rather than just number optimization games.

So, a balanced application of these strategies against collaborative partnerships founded on trust, transparency, and empathy between sellers and buyers allows constructive navigation of challenges.

As the business landscape continuously evolves, these mechanisms will grow in importance and usage. For high-ambition entrepreneurs, both upcoming and experienced, seeking the torch to be passed on smoothly while rewarding stakeholders aptly, creative deal engineering using seller financing and earnouts serves as pivotal enablers, allowing dreams to flourish.

Upcoming Article: 'The Consultant's Exit: Leveraging Your Expertise Post-Sale,' where we'll unveil effective strategies for consultants to engage and generate income post-sale, ensuring a prosperous and impactful continuation of their professional journey.

Previous Articles in This Series

01 - Building the Base: Cultivating an Organic Database of Potential Investors

The Foundation of Investor Engagement

02 - 1st Impressions: Master the Art of Introducing Your Business to Investors

Crafting an Irresistible Narrative Online and Offline

03 - The Engagement Equation: Strategies to Connect with Potential Investors

Turning Introductions into Meaningful Interactions

04 - Preparation is Key: Getting Your Business Ready for a Profitable Exit

Essential Steps to Prime Your Business for the Market

05 - Identifying Your Ideal Buyer: Selling Your Business to the Right Hands

Understanding Buyer Personas for Solopreneur and Small Business Sales

06 - The Art of the Deal: Exploring Types of Business Sales

From ESOPs to Mergers – What Suits Your Business Best?

Disclosure and Transparency Statement:

This article is founded on my industry knowledge and expertise, coupled with the assistance of artificial intelligence (AI) tools. As a committed advocate for small businesses and a pioneering voice in expanded capital solutions, I leverage technologies such as OpenAI, Bard, Bing, Claude, Grammarly, and other aids in my productivity, research, and composition processes interchangeably. This includes writing, editing, refining, or assisting in creativity, brainstorming, or outlining. The core substance of this content is sourced and prompted by my extensive experience and industry acumen of over 30 years. This and other blog posts have been refined to provide clarity and substance in service to the readers' success.